CASE STUDY PORTFOLIO

Client: Global professional social network

Type of project: Global research project for client

Value of project: $379,250

Length of project: 4 months

My role: Researcher, collaborated in project management (team of 5 researchers and 3 international research consultants)

Research methods used: video ethnographies, focus groups / co-design workshops (188 participants in 4 global markets, 6 cities)

Skills applied: Cross-team cooperation, communication, project planning and management, research design, insights generation, working with client and stakeholders, evidence-based strategy, report writing

Outcomes: A second phase research project was commissioned by client. Client asked us to deliver discovered insights presentations to their product, marketing and commercial strategy teams. 6 months after the first project ended, my company was commissioned a project focused on the Chinese market

1. The problem/challenges

Client commissioned my company to conduct a global research project that would support the development of products and marketing which were scheduled to be released in mid-2019. In each of these markets, we were asked to find out what are the professional benefits of a professional network to different kind of professionals (“why do professionals need to belong to a network like the company’s?”) with the objective to propose a value proposition the company can use for its marketing and drive product innovation. Likewise, we were asked to also present insights on the work culture of the different markets we were asked to conduct research on. Thus, the main goals of the research project were:

Explore how the member value proposition resonates with key audience segments in global markets both emotionally and functionally

Explore how the value proposition will impact product development, user experience, messaging and global adoption of the value proposition

The core questions guiding this research were:

What are the core needs of today’s professionals?

How might a constructive online community help people cope with this reality?

How can the company’s social network uniquely address professionals’ functional and emotional needs in an increasingly number of uncertainties in a complex modern work life?

2. Hypotheses

The research project was mostly explorative in nature, however there were some hypotheses that were at the basis of some of the new products and marketing were based. Among these, these stand out:

“Community” is an important value for professionals around the world, and the company can provide it through services and products

Value propositions should be global in nature. The work culture in different markets is not differentiated enough to warrant differentiated marketing messages and strategies

Most of the social network users use the platform to, ultimately, network with future job prospects in mind. This is a reason why senior leaders tend not to be as engaged as professionals earlier in their careers

As we will see later, our data and evidence proved these hypotheses false to an extent. Otherwise, our research helped deconstruct, look at in more detail, and reconstitute them so as to make them helpful for the client’s product, marketing and strategy teams.

3. Research methods and processes

My research team and I proposed to the client focusing on four distinctive markets. This would allow us to look at established markets (United States, Germany), emerging ones (India), and a market the company wanted to penetrate further (China). Likewise, in the United States, we focused on two cities outside New York and California to account for mid-sized markets and reduce the possibility of a bias due to our location and that of the client.

As a seasoned social sciences researcher, I proposed a series of approaches and methodologies to tackle the questions of this research. The client provided us with previous research they had commissioned that suggested that their most active members belonged to three segments we should focus on: a. career starters; b. career builders, and c. senior leaders.

From the beginning, I identified quantitative methodologies (surveys, data analysis) would not be useful, given that the main focus was on how meaning is created, the reasons why people react differently to different propositions, and to capture in-depth narratives of how they would relate personally to different value propositions. A non-quantitative methodological design would also allow us to explore the work culture of these users. With those goals in mind, I proposed two research methods:

Participant-submitted videos: Potential participants were required to submit a video short video (2-3 minutes long) recorded from their phones answering two questions. These videos would allow us to see some arising patterns from their answers that then could be incorporated into the group discussion and, in the end, in the final deliverables. The two questions to be answered in the video were:

Q1. What are the most pressing/impactful changes taking place in your professional life?

Q2. What’s the role colleagues, friends, family, peers play in your professional life? How do they help you? How do you help them?

Focus groups/workshops: These would allow us to gather information not so focused on personal trajectories (as would in-depth interviews) but rather from group participants talking and sharing with one-another in a setting were they would share some professional characteristics with other participants. These workshops would also allow a co-design exercise to take place.

These workshops allowed us to engage with participants in a single 2-hour session. These consisted of a series of exercises to explore common professional needs and local work culture, and test client-provided value proposition messages.

Recruitment and local research teams:

Three workshops were conducted (8-10 participants per group) in each city corresponding to the three pre-identified segments. We worked with research consultants in our network in each market, and they were tasked to conduct the workshops in each of the cities outside of the United States along with one of our research team members who flew there in person in order to help standardise methodological rigor.

I collaborated in building a recruitment screener. With it, an online recruiter in each of the markets was commissioned to identify 15 participants per segment. Once identified and their intention to participate assured, participants were asked to submit their videos and attend the 2-hour workshop with a deadline for submission. These videos were shared with the local research consultants, and I asked them to pick the 12 most interesting, making use of the consultant’s local perspective. After we got their input, our research team and I evaluated them.

Recruitment screener

For the particular case of China, as a rather new growing market for the client, in coordination with the local researcher and participant recruiter, we suggested to the client that, given local work culture differences, the three participant groups should be different from other markets. Specifically, they would be: a. Local career starters; b. Career builders WITHOUT international professional experience; and, c. Career builders WITH international professional experience. The client agreed.

Workshops/focus groups:

The focus groups in Boston and Chicago were led by a member of our research team, and in Bangalore, Delhi, Munich and Beijing by the hired local consultants and one of our team members. I personally conducted and evalued the workshops in Boston, Chicago and oversaw the workshop in Beijing. In each of these workshops, I met with a client representative who was there to be non-participating observers. Each of these sessions were recorded and transcribed (and translated) for analysis and to be used in the video project deliverables.

The workshops consisted of three exercises:

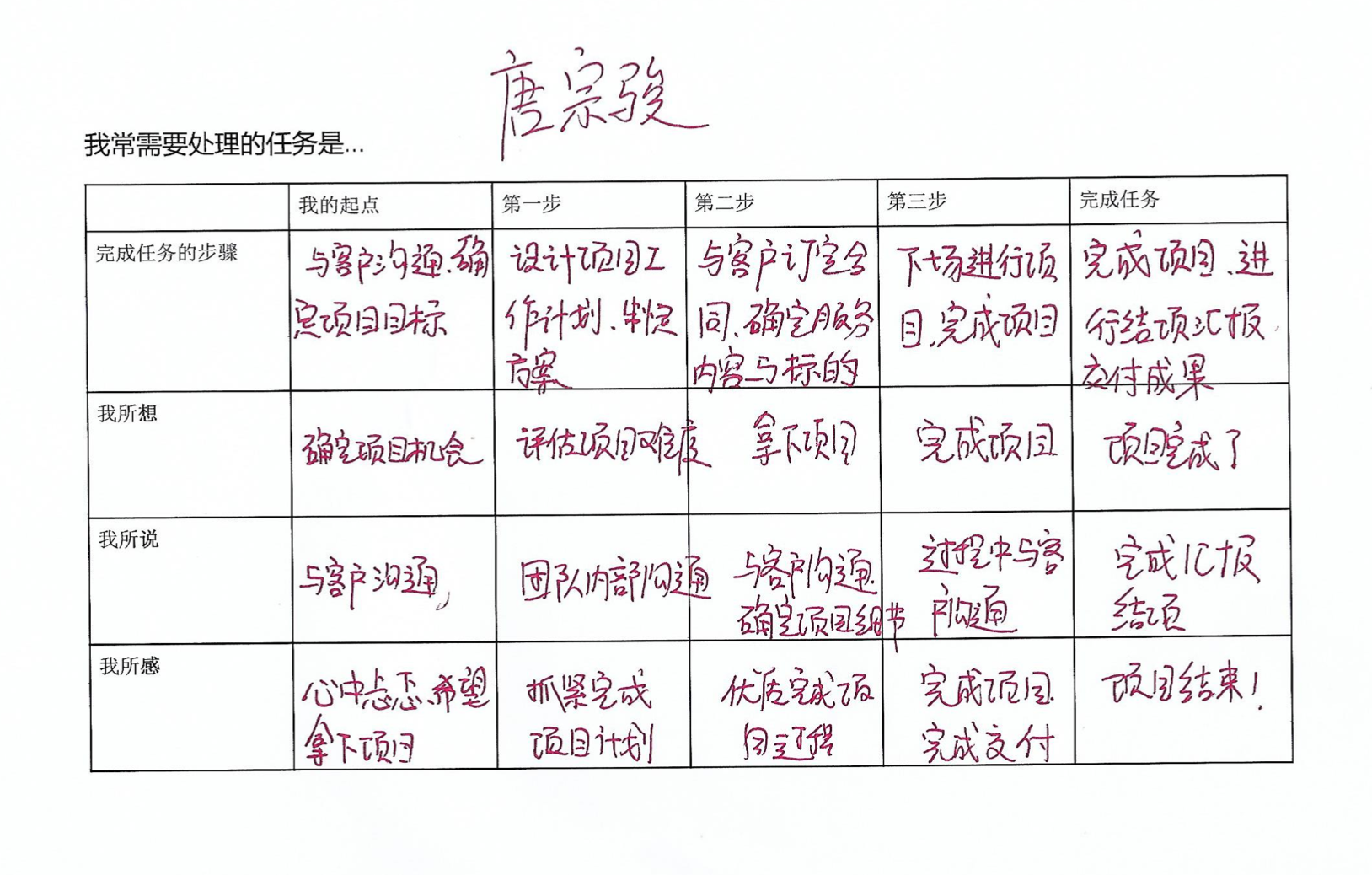

1. Filling an individual chart about an everyday task at work. We asked participants in the career starters, career builders and senior leaders’ groups to tell us more about how they go about completing a work-related task, who they rely on for help, and how they feel throughout the process. The goal was to understand the emotions that such a task brings up in participants and to set up a conversation about the usefulness of having the support of a professional network, whether online or offline.

2. Participants explored a “gallery wall” of unbranded stimulus that brought to life different dimensions of the value proposition. They reacted to the stimulus using emoticon stickers. The moderator led a discussion about the pieces of stimulus that evoked the strongest reactions (positive or negative), in order to understand what resonated well with them, what did not, and why.

Images from workshop in Munich

German stimulus

Stimulus filled with emoticon stickers

3. Participants took part in a group ideation session of new services, experiences, and opportunities that brought the value proposition to life in each market, and how they activate the functional and emotional benefits

Beijing

Boston

Insight generation sessions and follow-up research:

Back in New York City, all the research materials (including transcripts, videos, and photos) were gathered and brought back to be used locally for the insights sessions. In addition to this, I asked all international researchers to write a report with what they thought were some of the most interesting observations that came out of the workshops they moderated. The goal of this task was to be able to have, as much as possible, a local perspective on the ideas brought up at the workshop so as to avoid a possible bias from an external viewer in which we might incur as non-locals. The insights ideation sessions aimed at answering three basic questions:

What is the overarching value that the company can offer their users?

What is the emotional benefit that most deeply resonates with their users?

What is the role of community in delivering on the functional and emotional benefits?

After the first round of insights ideation sessions, the research team and I prepared and presented a preliminary report to the client focused on preliminary insights of each market. From then on, our research team and their consumer experience team were in constant communication to discuss their priorities.

These conversations about the gained local insights led the client to commission a complementary second project focused on two more groups in the United States: a. less engaged users, and b. professionals who are NOT members of the client’s social network. I wrote updated screeners and led the two workshops in Chicago, Munich and Delhi. This was largely an exploratory project, and therefore the small sample was never regarded as necessarily “representative”. Given how different these groups were from the ones in the first phase of the project, the insight ideation sessions for this second project took place in a differentiated manner.

After gaining input from the client regarding their priorities and goals, I organised a second round of insight ideation sessions to focus on the global insights (as opposed to those focused on each market). For this session, I organised a global ideation session with our research and business team, as well as with researchers in China, India, and Germany. This two-hour session was difficult to organise given the time-difference. After this global meeting, our team in New York conducted insights ideation sessions through the week. Likewise, in cooperation and constant communication with our design and creative team in London, we began to prepare a final report and an insights video, both of which aimed at using participants own words and evidence as a storytelling device to back the insights we presented to the client.

4. Findings/Results and reaction from client

Due to NDAs in place, I cannot share all the findings of this project, but the following ones are representative of the kind of insights that were delivered to the client:

Across markets and segments, users expressed a number of challenges of modern work life they have to deal with. Some of these included the lack of roadmaps, increasing economic uncertainty, information overload, competitive job markets and a constant need to learn

As they progress in their professional lives, the challenges they face evolve. Career starters are looking for guidance, career builders need to deal with unpredictability, and senior leaders need to stay relevant

Across the board, users expressed “confidence” as the most pressing emotional need in their professional lives. Confidence is highly desireable and it resonates across all markets and segments

For participants, confidence is built through a series of actions and interactions that give users a feeling of control. Actions lead to control, which leads to confidence. Likewise, confidence is earned, not assumed

Having a community helps users work, learn and grow, but it is unclear how this can be delivered by an online community. Users see clear value in community when it comes to achieving professional goals

To ensure credibility and trust, members look for clarity on shared goals and rules of engagement

Participation in communities is driven by self-interest, thus end benefits must be clear to users. Personal growth improves people’s sense of identity, develops talents and potential and builds social capital. This is what fundamentally drives behaviour, even when people appear to act altruistically. Likewise, members get personal satisfaction from helping others

Regarding the practical value of the company’s social network to its members:

Regarding the fact that the social network is used by almost all members to find jobs: jobs are stepping stones on a bigger journey of growth and development, but people need more information about job and workplace in order to feel they can make better decisions

Criteria for choosing the right job is changing

Regarding the need to stay informed: people want highly curated and credible information. Large availability of professional information is a problem

Regarding the need to work more effectively: being part of users’ day-to-day work life is a big opportunity for the client. But today, the social network does not equip members to work more effectively

To help members work more effectively, we suggested the client to foster dialogue to build trust and minimize uncertainty between members, create a rating system to promote expertise, make community as go-to source of targeted knowledge, promote participation in groups using point systems to reward it.

Regarding the emotional benefits:

Having a sense of “belonging” improves motivation and gives people the feeling that they’re tapped into something bigger than themselves. Supportive social networks can act as buffers against stress

5. Deliverables and reactions

All insights were delivered making extensive use of the participants own voices and quotes, as well as with the research materials that showed their opinions. In addition to the global insights, we also presented to the client insights briefs for each market and from research focused on less engaged users and non-users (second phase of the research project). Detailed strategy recommendations were also provided as part of the deliverables.

Samples from the final report to the client

Screengrabs from video deliverable

As the most seasoned researcher in this project, along with my company’s global CEO, we gave a 45-minute long presentation to the client company’s vice-president and consumer experience leadership. The presentation went smoothly, but some criticism was generated due to how the insights and conclusions invalidated some of the assumptions and hypotheses their upcoming new products and marketing campaigns were based on. We responded to this by showing how that was not necessarily the case; in fact, our insights provided alternatives with which to rework value propositions and re-evaluating product design based on the strong evidence we collected and provided them with. Likewise, at every step of the way, it was important to show strong research evidence (mostly making extensive use of the participants own quotes) to back our claims.

Two days after presenting the findings, my team and I were asked to present the findings to the client’s product and strategy teams. Likewise, we were further asked to participate in a workshop session with their team managers and marketing teams. Furthermore, six months later, the client’s office in China commissioned us to conduct a follow-up research project focused on that market.